盘后小结

美股震荡收跌,中概股多数上涨,阿里巴巴逆势跌6%。

阿里巴巴向SEC注册股份

从彭博的数据上,能看出阿里巴巴历史上一共提交过两次F-6EF。

第一次是19年,提交的文件向SEC注册了5亿股ADS。在这一次文件中,阿里巴巴是写明了注册的目的,是方便雅虎出售持有的股份,雅虎当时持有3.8亿股ADS。

This Registration Statement on Form F-6 is being filed and the ADSs are being registered in order to accommodate the issuance of additional ADSs upon the deposit of ordinary shares, including deposits by current holders of ordinary shares who have indicated to the Company and the depositary their intent to do so in the short term. In particular, on May 15, 2019, Altaba Inc., one of the Company’s principal shareholders, announced that it intends to commence sales of our ADSs on May 20, 2019. Altaba stated that it will sell no more than 50% of the Company’s ordinary shares it holds prior to receiving stockholder approval of its previously announced liquidation and dissolution plan. Altaba’s stockholder meeting to vote on the plan is scheduled to be held on June 27, 2019. If the plan is approved at the stockholder meeting, Altaba may sell up to 100% of its Alibaba shares, although Altaba has stated that actual commencement of selling, the timing and method of sales, and other related transaction considerations will be determined at its discretion, and the plan is subject to change based on prevailing market conditions and other factors. The additional ADSs registered hereby will, among other things, accommodate the issuance of ADSs that will be required in connection with such contemplated sales by Altaba Inc. as well as in connection with sales by others, including current and former employees who receive ordinary shares from our employee share ownership plans.

这次提交的文件注册了10亿股ADS,是19年的两倍之多,但是阿里巴巴却没有说明是什么大股东要卖。

This Registration Statement on Form F-6 is being filed and the ADSs are being registered in order to accommodate the issuance of additional ADSs upon the deposit of ordinary shares, including deposits of the Company’s ordinary shares that are listed on the Hong Kong Stock Exchange.

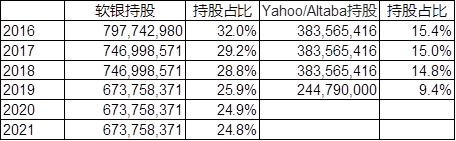

有投行猜测是软银要出售,这个猜测不无道理。一来软银持股有6.7亿股ADS,二来今天晚上马上就是软银季报。为了保护软银的季报,阿里巴巴不好事先剧透。软银可能会自己说。

当年雅虎是通过二级市场就将所持有的股份全部卖光,售出时间不到一年。

这个消息当时出来的时候(5月份),阿里巴巴股价是跌了一波,不过从2019年全年表现来看,阿里巴巴的股价甚至还跑过了当年的标普500指数。下图白色是阿里巴巴,橙线是标普500。不过当年的阿里巴巴季报能够振奋人心的不少。

如果这次软银还是选择和雅虎一样,在二级市场卖出是当年两倍的股份,那么股价压力就大了。如果有人能够接盘,哪怕只是一部分股份,或者好几个人一起接盘,会好一些。

期待今晚软银季报揭晓。

大市(美东时间4:00 PM)

道琼斯: 35,091(+0.00%)

标普500: 4,483(-0.37%)

纳斯达克: 14,015(-0.58%)

黄金期货: 1,821(+0.78%)

原油期货(WTI): 91.52(-0.86%)

美债十年利率: 1.92%(+1bps)

伦敦富时100指数: 7,573(+0.76%)

FXI收盘价: 37.75(-0.61%)

KWEB收盘价: 35.58(-2.36%)

离岸人民币CNH: 6.3625(-0.02%)

美元指数: 95.43(-0.06%)

比特币: 43,979(+5.48%)

公司新闻

Take-Two(TTWO):3季度营收和4季度指引均不及预期,盘后跌2%。新品规模有限,《侠盗猎车手V》将延迟至3月在Xbox以及PlayStation平台发布。

Phunware(PHUN):宣布与Campaign Nucleus建立战略政治伙伴关系,收盘涨17%。后者为中右翼候选人、组织和企业提供人工智能数字平台,双方合作后将加强Phunware在移动领域的智能宣传解决方案。

Astra Space(ASTR):美NASA:Astra火箭发射在发动机启动时中止,收盘跌14%。公司表示,取消发射的原因是一个小的遥测问题,将放弃今日发射窗口中再次尝试。

苹果(AAPL):荷兰反垄断监管机构周一再次对苹果处以约合$571万的罚款。原因是苹果未能遵守在荷兰开放其应用商店为约会应用提供第三方支付系统的命令。苹果累计已向荷兰消费者和市场管理局支付罚款达€1,500万。

雾芯科技(RLX):申报国内首个电子烟安全性临床研究。雾芯表示作为国内首个利用现代医学、毒理学等方法开展系统性研究的电子烟品牌,将持续投入科研,带动行业规范发展。雾芯股价较IPO后高点已下跌近90%。

其它

全球确诊396,672,942 (+3,455,699)例,死亡5,746,187 (+11,791)例。

美国确诊76,511,821 (+53,677)例,死亡902,635 (+369)例。

纽约州确诊4,852,369 (+7,089)例,死亡65,760 (+134)例。

Gartner:2021年全球半导体收入$5,835亿,同比增长25.1%。

中概股涨跌榜

箩筐技术 LKCO $0.63 +24.27% 诺亚财富 NOAH $29.24 -5.46%

嘉楠科技 CAN $4.83 +7.10% 优克联 UCL $1.47 -5.48%

涂鸦智能 TUYA $5.86 +6.16% 阿里巴巴 BABA $114.82 -6.05%